Thought Leadership

Atlanta Has A Zombie Problem

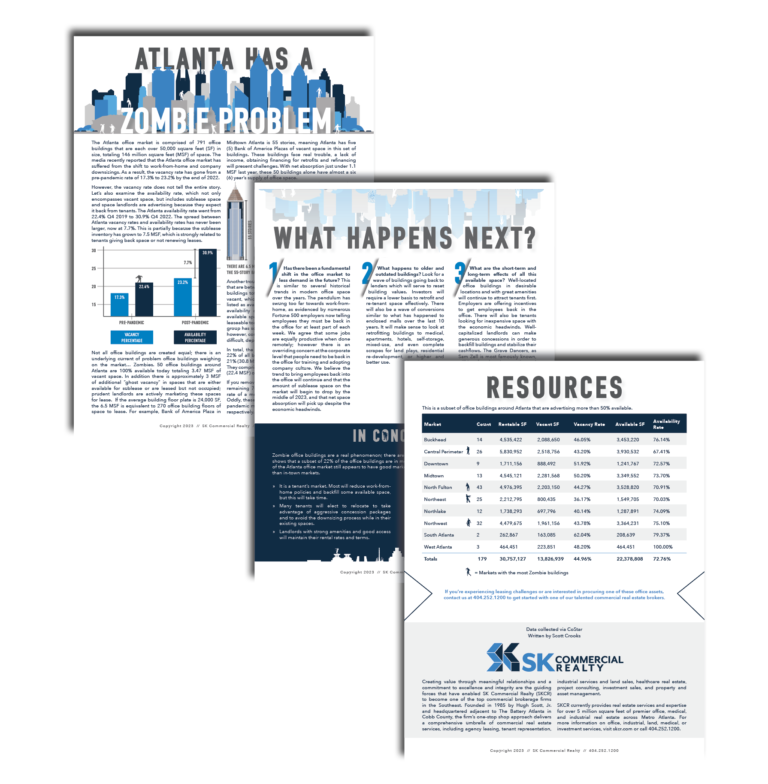

The Atlanta office market is comprised of 791 office buildings that are each over 50,000 square feet (SF) in size, totaling 146 million square feet (MSF) of space. The media recently reported that the Atlanta office market has suffered from the shift to work-from-home and company downsizings. As a result, the vacancy rate has gone from a pre-pandemic rate of 17.3% to 23.2% by the end of 2022.

However, the vacancy rate does not tell the entire story. Let's also examine the availability rate, which not only encompasses vacant space, but includes sublease space and space landlords are advertising because they expect it back from tenants. The Atlanta availability rate went from 22.4% Q4 2019 to 30.9% Q4 2022. The spread between Atlanta vacancy rates and availability rates has never been larger, now at 7.7%. This is partially because the sublease inventory has grown to 7.5 MSF, which is strongly related to tenants giving back space or not renewing leases.

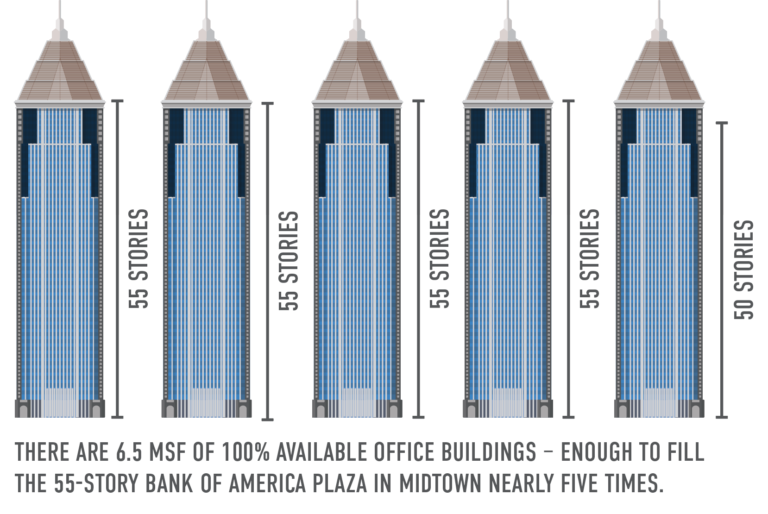

Not all office buildings are created equal; there is an underlying current of problem office buildings weighing on the market… Zombies. 50 office buildings around Atlanta are 100% available today totaling 3.47 MSF of vacant space. In addition there is approximately 3 MSF of additional "ghost vacancy" in spaces that are either available for sublease or are leased but not occupied; prudent landlords are actively marketing these spaces for lease. If the average building floor plate is 24,000 SF, the 6.5 MSF is equivalent to 270 office building floors of space to lease. For example, Bank of America Plaza in Midtown Atlanta is 55 stories, meaning Atlanta has five (5) Bank of America Plazas of vacant space in this set of buildings. These buildings face real trouble, a lack of income, obtaining financing for retrofits and refinancing will present challenges. With net absorption just under 1.1 MSF last year, these 50 buildings alone have almost a six (6) year's supply of office space.

Another troubling tranche of the office market are buildings that are between 50% to 98% available. They comprise 126 buildings totaling 23.9 MSF. 43% of this space is already vacant, which is 10.3 MSF. Another 5.4 MSF of space is listed as available, giving this set of buildings an average availability of 65.9%. These buildings have 15.7 MSF available space, equivalent to 655 floors of office space leaseable today or another 12 Bank of America Plazas. This group has some wiggle room as they have some income; however, convincing lenders to retrofit or refinance will be difficult, depending on the project.

In total, the Zombie office buildings in Atlanta make up 22% of all buildings in the market (179) and account for 21% (30.8 MSF) of the total rentable office space in Atlanta. They comprise 40% (13.8 MSF) of all vacant space and 49% (22.4 MSF) of all available space in Atlanta.

If you remove the Zombie buildings from the statistics, the remaining 78% of office space in Atlanta has a vacancy rate of a mere 17.7% and an availability rate of 20.2%. Oddly, these numbers compare very favorably to the pre-pandemic market, with percentages at 17.3% and 22.4%, respectively.

So what happens next?

- Has there been a fundamental shift in the office market to less demand in the future?

This is similar to several historical trends in modern office space over the years. The pendulum has swung too far towards work-from-home, as evidenced by numerous Fortune 500 employers now telling employees they must be back in the office for at least part of each week. We agree that some jobs are equally productive when done remotely; however there is an overriding concern at the corporate level that people need to be back in the office for training and adopting company culture. We believe the trend to bring employees back into the office will continue and that the amount of sublease space on the market will begin to drop by the middle of 2023, and that net space absorption will pick up despite the economic headwinds. - What happens to older and outdated buildings?

Look for a wave of buildings going back to lenders which will serve to reset building values. Investors will require a lower basis to retrofit and re-tenant space effectively. There will also be a wave of conversions similar to what has happened to enclosed malls over the last 10 years. It will make sense to look at retrofitting buildings to medical, apartments, hotels, self-storage, mixed-use, and even complete scrapes for land plays, residential re-development, or higher and better use. - What are the short-term and long-term effects of all this available space?

Well-located office buildings in desirable locations and with great amenities will continue to attract tenants first. Employers are offering incentives to get employees back in the office. There will also be tenants looking for inexpensive space with the economic headwinds. Well-capitalized landlords can make generous concessions in order to backfill buildings and stabilize their cashflows. The Grave Dancers, as Sam Zell is most famously known, will buy foreclosed properties and discounted debt to gain control of buildings. These investors will have a much lower basis in their properties and will be able to upgrade the buildings and put out competitive space that could depress rental rate growth over the next 18 months.

Zombie office buildings are a real phenomenon; there are 179 of them. A deeper dive into the Atlanta office market shows that a subset of 22% of the office buildings are in moderate to significant financial distress. In comparison, 78% of the Atlanta office market still appears to have good market fundamentals. The suburbs have more zombie properties than in-town markets, but the markets overall are tenants' markets. Most tenants will reduce work-from-home policies and backfill some available space, but this will take time. Many will elect to relocate to take advantage of aggressive concession packages and to avoid the downsizing process while in their existing spaces.

Landlords with strong amenities and good access will maintain their rental rates and terms, while those with deferred maintenance or few amenities will compete for tenants looking for inexpensive space. These landlords will have to offer high concessions. Lenders and debt holders will have to decide if they will provide work-out terms with current landlords or if it makes more sense to cut losses, foreclose or flip debt to investor groups.

Real Zombies may eat brains, but Zombie office buildings thrive on the post-pandemic chaos left behind in all of America's largest cities. SK Commercial Realty can save you from this particular apocalypse - contact us today to resurrect your Zombie!

To view our whole report, written and researched by Scott Crooks, click here.